Our Estate Planning Attorney Diaries

Table of ContentsEstate Planning Attorney Things To Know Before You BuyLittle Known Facts About Estate Planning Attorney.Some Ideas on Estate Planning Attorney You Should KnowNot known Factual Statements About Estate Planning Attorney

Your lawyer will certainly likewise assist you make your files authorities, arranging for witnesses and notary public trademarks as required, so you do not need to fret concerning attempting to do that last step on your very own - Estate Planning Attorney. Last, but not the very least, there is valuable assurance in developing a relationship with an estate preparation attorney that can be there for you later onJust put, estate preparation attorneys supply worth in many ways, far beyond merely offering you with printed wills, trusts, or various other estate planning papers. If you have inquiries about the procedure and wish to discover extra, call our office today.

An estate planning lawyer helps you define end-of-life decisions and lawful papers. They can establish wills, establish counts on, develop health care directives, establish power of attorney, create succession strategies, and a lot more, according to your dreams. Collaborating with an estate preparation lawyer to finish and oversee this legal paperwork can help you in the following eight areas: Estate intending lawyers are professionals in your state's depend on, probate, and tax regulations.

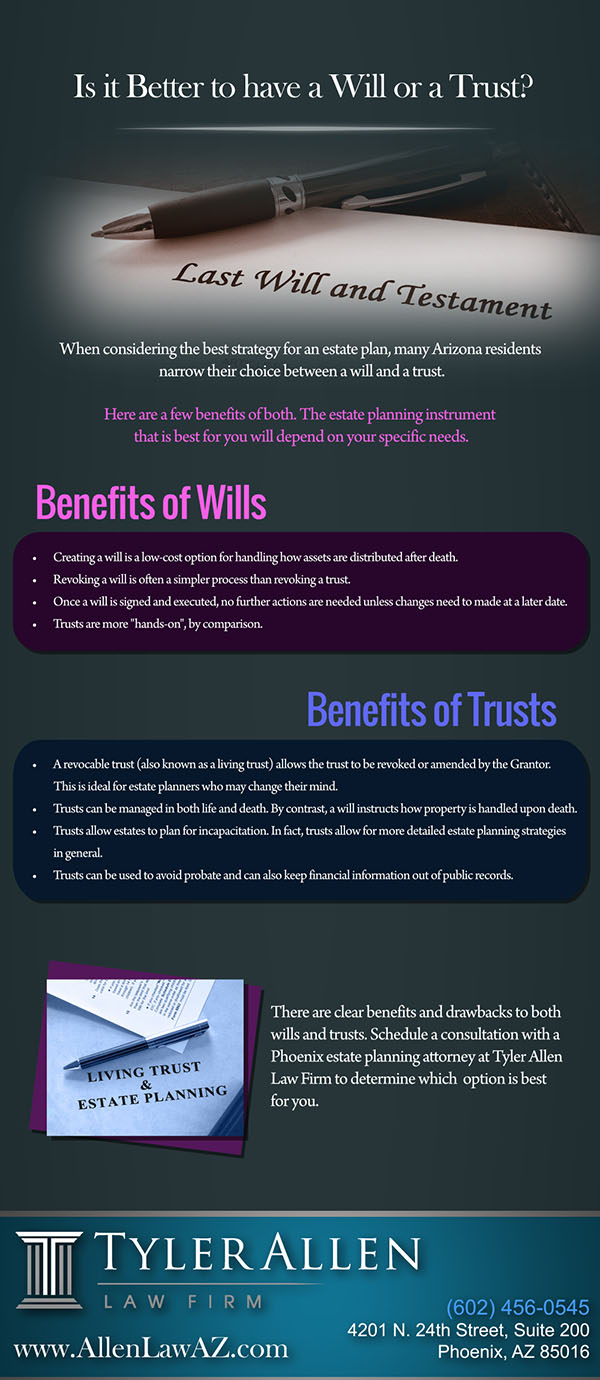

If you don't have a will, the state can decide how to separate your properties among your successors, which may not be according to your dreams. An estate preparation attorney can assist arrange all your legal documents and distribute your possessions as you wish, possibly staying clear of probate. Lots of individuals prepare estate planning papers and after that forget them.

Indicators on Estate Planning Attorney You Should Know

Once a client dies, an estate strategy would determine the dispersal of assets per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these choices may be entrusted to the near relative or the state. Tasks of estate organizers include: Creating a last will and testament Establishing up depend on accounts Naming an administrator and power of attorneys Determining all recipients Calling a guardian for small children Paying all financial debts and minimizing all taxes and legal charges Crafting guidelines for passing your worths Establishing preferences for funeral arrangements Finalizing instructions for treatment if you become unwell and are not able to make choices Getting life insurance, disability earnings insurance coverage, and long-lasting care insurance coverage A good estate plan must be updated frequently as customers' economic scenarios, personal motivations, and federal and state legislations all advance

Similar to any type of career, there are attributes and abilities that can assist you achieve these goals as you collaborate with your customers in an estate coordinator duty. An estate preparation career can be right for you if you have the complying with traits: Being an estate check my source coordinator means assuming in the long term.

Estate Planning Attorney for Dummies

You have to assist your customer expect his/her end of life and what will take place postmortem, while at the same time not home on morbid thoughts or emotions. Some customers may come to be bitter or troubled when considering fatality and it could drop to you to help them via it.

In the event of death, you may be anticipated to have numerous discussions and dealings with enduring relative about the estate strategy. In order to succeed as an estate coordinator, you may require to walk a fine line of being a shoulder to lean on and the specific depended on to communicate estate planning issues in a prompt and right here specialist way.

tax code changed hundreds of times in the one decade between 2001 and 2012. Expect that it has been altered even more since then. Depending on your customer's financial income brace, which may evolve towards end-of-life, you as an estate coordinator will have to keep your client's assets completely lawful compliance with any type of local, government, or international tax obligation legislations.

5 Easy Facts About Estate Planning Attorney Explained

Gaining this qualification from companies like the National Institute of Licensed Estate Planners, Inc. can be a strong differentiator. Belonging to these specialist groups can verify your abilities, making you extra appealing in the eyes of a prospective go right here client. In enhancement to the emotional reward helpful customers with end-of-life planning, estate coordinators take pleasure in the benefits of a secure earnings.

Estate planning is a smart thing to do regardless of your current health and economic standing. The very first crucial thing is to work with an estate planning lawyer to assist you with it.

The percentage of people that do not know just how to obtain a will has boosted from 4% to 7.6% given that 2017. A seasoned lawyer knows what info to consist of in the will, including your beneficiaries and unique factors to consider. A will protects your family members from loss as a result of immaturity or incompetency. It also offers the swiftest and most reliable technique to move your possessions to your recipients.